401(k) Savings Plan

We make it easy and convenient to build a nest egg for retirement with the 401(k) Savings Plan.

We make it easy and convenient to build a nest egg for retirement with the 401(k) Savings Plan.

With pre-tax contributions, you get an immediate tax break by lowering your taxable income. You don’t pay taxes on your savings or earnings until you start withdrawing from your account.

You pay taxes up front on Roth contributions so you can withdraw money tax-free once you retire — earnings on Roth contributions may also be tax-free once you meet distribution requirements. Visit voyadelivers.com/Roth for more information.

You can defer up to 75 percent of your pay, up to IRS limits. IRS limits are subject to change. You can find the most current IRS limits at voya.com/IRSlimits. You are always 100 percent vested in your contributions.

After completing one year of service, plan participants are eligible for a Safe Harbor employer-matching contribution. The company matches 100 percent of the first 6 percent of your contributions. All Safe Harbor employer-match contributions are immediately 100 percent vested.

Voya Institutional Plan Services (VIPS), LLC is our 401(k) plan record-keeper. Voya provides you with plan information, saving and investing education, transaction processing, and more on your journey to retirement.

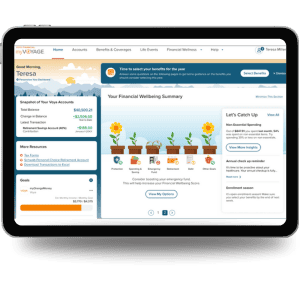

myOrangeMoney®: An educational, interactive online experience that shows you how your current retirement savings may translate into monthly retirement income.

Personal Financial Dashboard: A web-based tool that enables you to organize, integrate and manage all of your financial information on one digital platform.

Voya Retire Mobile App: A fast and easy way to access your retirement account on the go! Search “Voya Retire” in your app store.

Financial Wellness Experience: Take a personal assessment today to gain insights that will help you take meaningful actions for your financial future.

Your 401(k) Savings Plan is an integral part of your retirement saving strategy. Enroll today by calling 1-833-BPRO401 (1-833-277-6401) or visiting basspro401k.voya.com and selecting Register Now.

This Voya eBook provides an overview of the plan features and information on saving and investing for retirement. You can also view informational videos.

Voya is committed to safeguarding your plan accounts and personal information from the risk of fraud, cyber threats and unauthorized activity — so much so, we established the Voya S.A.F.E. (Secure Accounts for Everyone) Guarantee.

If any assets are taken from your workplace retirement plan account due to unauthorized activity and through no fault of your own, we will restore the value of your account, subject to you taking action to satisfy the following key steps:

You can find more information on safeguarding your personal data at voya.com/articles/safe-guarantee.